As a business connected to automobiles, you have to be very careful while importing goods. The entire import process requires careful navigation of customs clearance procedures. Moreover, each country enforces specific regulations and tariffs. If you don’t follow the procedure to the T, your expensive shipment will be wasted while awaiting customs clearance.

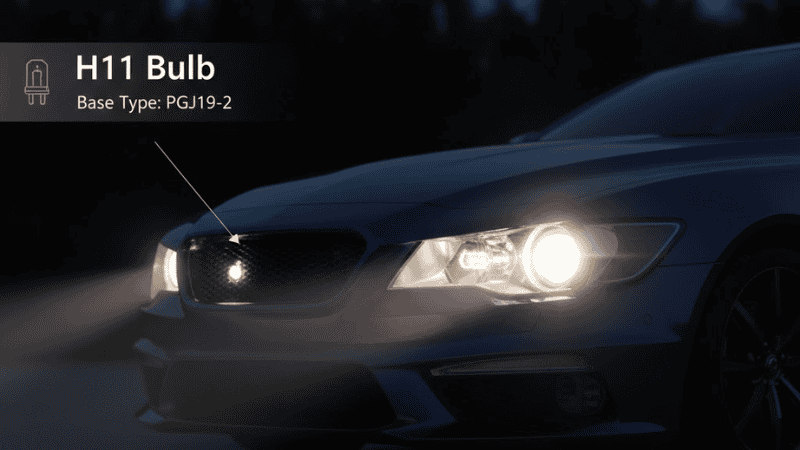

In this guide, we have covered all aspects of importing headlights, from documentation required for import to country-specific compliance. Let’s educate so you can keep your business streamlined.

Country-Specific Policies and Tax Implications

Whether you are importing from the East or the West, each country imposes distinct regulations. These regulations are not only related to taxes and tariffs. They also relate to documentation and compliance requirements. Here is a country-specific breakdown of key regulations for LED headlight import.

United States

Several agencies come into play when you are importing anything to the USA. Given that the USA is one of the largest automobile markets, it has an extensive set of rules for LED headlight import.

Required Documents for Headlight Import

The first thing you need is an “agent for service of process.” This title is for a designated individual who will tackle any legal issues on behalf of your company. Then you need to prepare CBP Form 7501 for the entry summary and the NHTSA-DOT HS-7 Declaration form.

CBP Form 7501 is used for entry summary, and the NHTSA-DOT HS-7 Declaration form is required to declare that the imported vehicle or equipment complies with applicable Federal Motor Vehicle Safety Standards (FMVSS). These two documents are specific to the US market only.

A special Theft prevention manual has been introduced by NHTSA. It allots a special vPIC number to auto parts that make them traceable. Thus preventing the sale and use of stolen auto parts and deterring such criminal activities.

Agencies involved and their role

It is vital to have basic knowledge of agencies that can be involved in your LED or Halogen headlight shipment processing.

- Customs and Border Protection (CBP) ensures all shipments are compliant with associated regulations.

- The Environmental Protection Agency (EPA) will only come into play if you use mercury in your headlights. In this case, you will need to inform the agency prior to sending the shipment. It is upon them to determine if it is permissible to import your headlights to the US.

- The Department of Transportation (DOT) is responsible for road safety. It ensures your headlight follows the regulations set by the National Traffic and Motor Vehicle Safety Act of 1966. The regulations are enacted by NHTSA.

- The Federal Trade Commission (FTC) provides general oversight of imports. It is mostly related to packaging and marketing-related business practices. The purpose is to ensure your product’s alleged information aligns with its specs.

- The Consumer Product Safety Commission (CPSC) ensures that consumers in the USA receive safe-to-use products. To be compliant with their standards, your items have to be built in accordance with FMVSS (Federal Motor Vehicle Safety Standards).

Tariffs and Taxes

The import duty rates vary based on the Harmonized Tariff Schedule (HTS). However, the general import duty is 2.5 percent. As far as regulatory compliance is concerned, you have to follow either EPA or CARB standards. Half the states require EPA-standard auto parts; the other half follow CARB regulations.

There is a special 25 percent tariff imposed on the import of Chinese auto parts. This tariff is placed in addition to the standard 2.5% import duty.

European Union

To import any goods to any of the member states of the European Union, you have to follow the rules set by the European Union Customs Union. It contains the legal framework of the Union Customs Code that regulates the movement of goods in the EU.

Moreover, it is important to note that the importer is held accountable for the product. The manufacturer is generally exempt from any liability.

Required Documents for Headlight Import

As far as documents are concerned, the importer is responsible for filing the Summary Declaration on the day of import. The summary declaration consists of the product and shipment summary that is being brought into the EU. The Single Administrative Document (SAD) must contain all information, including the customs duties and VAT.

The SAD, once approved, is valid for all member states of the EU. All important information regarding import/export forms is contained within Commission Delegated Regulation (EU) No. 2015/2446.

In order to lodge a customs declaration or summary declaration, you will need an EORI. It is the economic operator registration and identification (EORI) number. To obtain an EORI, you have to request Authorized Economic Operator (AEO) certification.

Once you are allotted an EORI, the customs procedures will become significantly easier and quicker to navigate.

Along with the SAD and summary declaration, you must present a declaration of conformity and a technical file. These documents ensure your shipment contains products that follow European safety standards.

Clearances

The product imported to the EU has to go through clearance under the EU directives. The EU directives ensure that app products comply with EU standards. The compliance is shown by the CE (Conformité Européenne) mark. However, the CE mark has to be accompanied by

EU directives Declaration of Conformity and a technical file. So as not to leave any suspicion regarding the product’s safety.

Tariffs and Taxes

A common customs tariff (CCT) is applied to all imports from the external borders of the EU. It is common to all the EU members. But the rate differs depending on the type of product and the country of export. Ultimately, the tariff boils down to the economic sensitivity of the product.

You can find the updated customs tariff for the headlight in the combined nomenclature. It is a tool for classifying goods that meet the requirements of CCT and the EU’s trade statistics.

United Kingdom (UK)

Ever since Brexit, the UK has created its own set of import and export rules. These regulations differ from the EU; hence, you need to be wary of them while importing to the UK.

The import control is placed on two countries for headlights. There is a complete prohibition on the import of headlights from North Korea. At the same time, there is a restriction on the entry into free circulation of commodities from Ukraine.

Regulatory Requirements

There are specific regulations for headlight imports in the UK. In order to import headlights or the entire car, you have to follow these regulations. One regulation is that the headlight should produce a beam pattern that is suitable for left-hand traffic.

The marking for product conformity with UK laws is UKCA. In order to affix this marking to your product, you have to file the UK Declaration of Conformity.

Your product must comply with the Electromagnetic Compatibility Regulations 2016 and the Electrical Equipment (Safety) Regulations 2016, among others. The headlight color or tint laws are also important.

Required Documents for Headlight Import

The standard documents are required while importing headlights to the UK. These include import declarations, commercial invoices, transport documents, etc. The documents specific to headlights that need to be included are the technical file and the instruction manual.

Agencies Involved and Their Roles

Primarily, there are two agencies concerned with headlight imports to the UK. The HM Revenue and Customs (HMRC) oversees the customs declaration, taxes, and duties. In comparison, the Driver and Vehicle Standards Agency (DVSA) ensures that the product meets safety standards.

Tariffs and Taxes

Tariffs and taxes on products being imported to the UK depend on the commodity code. You can find the right commodity code for your goods from the trade tariff tool. There are four categories of commodity codes for headlights. However, the VAT (20%) and third-country duty (2%) are the same for all headlight categories. Currently, the commodity code for headlights is 8512.

These codes can help you understand all legalities around the import or export of the product in question.

Australia

Australia has one of the most stringent customs processes in the world. Whether you want to import or export, you will have to follow the process exactly as described. Otherwise, your expensive shipment can remain stuck in customs for a long time.

In Australia, all products are classified under a Harmonised System Code. This classification system was created in accordance with the Customs Tariff Act of 1995. These codes not only vary depending on the product but also on the destination of import and export. The HST for headlights under the ChAFTA is 8512.10.00. ChAFTA is the China-Australia free trade agreement.

While importing headlights to Australia, make sure they are securely packaged. For labeling, you need to prepare a trade description and the manufacturing country name. These requirements are specified under the Commerce (Trade Descriptions) Regulation 2016.

Documents

The list of documents required for import to Australia is evaluated by the Australian Border Force.

- Commercial invoices are crucial trade documents that specify transaction data such as buyer/seller addresses, product descriptions, prices, currency, and payment terms. Australian customs uses this to compute tariffs and taxes.

- The packing list contains a complete analysis of shipment contents, such as quantities, weights, dimensions, and packaging information. Customs officials verify it against other documentation.

- The packing declaration confirms conformity with Australia’s packing and quarantine requirements.

- A certificate of origin certifies the production country of the goods. This allows you to benefit from Australia’s free trade agreements, potentially lowering duties.

- Additional Declarations or Permits: Certain lighting items may require additional permits, such as a fumigation declaration (e.g., BMSB Treatment Certificate) for shipments from high-risk nations.

Tariffs and Taxes

The typical customs duty is 5%. However, free trade agreements or tax concessions reduce the duty to a negligible amount. The GST, on the other hand, is 10%. It is applied to the total import value of the shipment. The import value includes the customs value, duty tax, and transport and insurance costs.

| ountry/Region | Time frame for clearance | Documents required | Regulatory requirements | Regulatory bodies |

|---|---|---|---|---|

| USA | 2-5 days | CBP Form 7501 NHTSA-DOT HS-7 Declaration form | EPA or CARB | CBPDOTFTC |

| EU | 1-2 days | Summary declaration SAD declaration of conformity technical file |

CE (Conformité Européenne) | EU directives |

| UK | 1-4 days | Import declaration Technical file Instruction manual |

UKCA | HMRC DVSA |

| Australia | 1-3 days | Commercial invoices, Packing list, and declaration, Certificate of origin | Biosecurity regulations | Australian Border Force (ABF) |

General Documents for Headlight Import

Each country has its own set of rules that require various specific documents for headlight import. We have covered the specific documents you need to prepare for the major regions. However, you should know about the general documents required for headlight import as well.

Here is a comprehensive list of documents required for headlight import and their purpose.

- Commercial invoices provide transaction details such as buyer/seller information, product descriptions, value, and payment terms. Customs assesses these documents to calculate duties and taxes.

- The packing list contains information on the shipment’s contents, such as quantities, weights, and packaging specifics. Allows customs to verify the items against other documentation.

- A bill of lading (B/L) or airway bill (AWB) is a shipping document. It is produced by the carrier to certify shipment details and ownership transfer. Required for customs clearance and delivery.

- The Certificate of Origin (COO) certifies the country in which the headlights were made. It is used to establish eligibility for trade agreements and tariff reductions.

- An import declaration is a necessary document filed with customs that describes the imported goods for clearance. Enforces conformity with import regulations.

- Customs duty and tax documents act as proof of payment or calculation of appropriate customs duties, VAT, or sales tax. It is required for the release of goods.

- A packing declaration confirms adherence with packaging rules and is frequently required for biosecurity checks (particularly for wooden packing).

- Technical compliance documents include safety certifications, test reports, or conformity declarations confirming that headlights fulfill specified standards (e.g., CE, DOT, ECE).

- Import Permits (if applicable)—Some nations may require a special permit for vehicle parts, particularly those containing hazardous elements.

- Insurance Certificate. It is the proof of insurance coverage for the shipment in the event of damage or loss in transit.

- Inspection Certificates (if required): Some nations need pre-shipment inspections to ensure product quality and conformity before importing.

Frequently Asked Questions

Q. What is a customs bond, and when do I need one?

A customs bond is a financial assurance required by customs authorities to secure duty and tax payment as well as regulatory compliance. It is often required for high-value or commercial shipments, particularly in nations such as the United States, where importers must post a bond for items above $2,500.

Q. What is a homologation certificate?

A homologation certificate is an official document that certifies that a product, such as automobile headlights, fulfils the regulatory and safety criteria of a given country or region. Before a product can be lawfully marketed or used, it must comply with standards such as ECE (Europe), DOT (United States), and CCC (China).

Conclusion

Importing headlights involves meticulous attention to documentation, customs duties, and regulatory compliance. Having the proper paperwork, such as the commercial invoice, packing list, and import declarations, helps simplify customs processing.

Understanding duty rates, taxes, and potential exemptions might help you avoid unexpected charges. Furthermore, compliance with safety standards via homologation certifications and technical documentation is essential for legitimate market access.

To minimize delays and hassles, deal with professional customs brokers and keep up with changing import requirements. With proper planning, you can ensure that your headlights are imported smoothly and efficiently.

Ensure Hassle-Free Headlight Imports—Request Your Compliance Plan Now

Importing headlights does not have to be complicated. With the proper documentation, compliance techniques, and expert assistance, you may simplify the process and avoid costly delays. At Car Light Vision, our team is available to help you navigate customs laws, duty exemptions, and documentation. Contact us today to ensure a seamless and hassle-free import experience!